Understanding your rates invoice

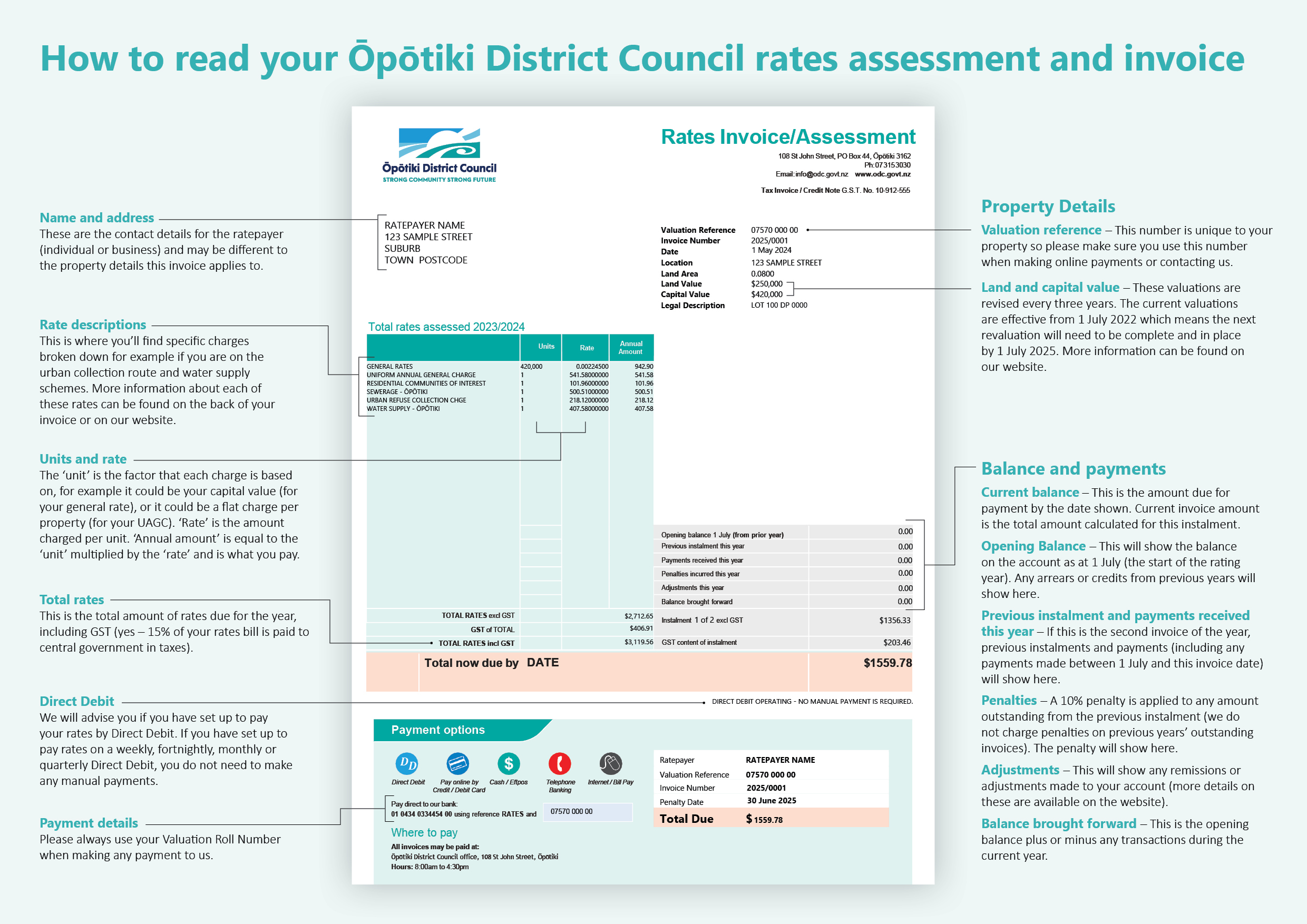

Name and address – these are the contact details for the ratepayer (individual or business) and may be different to the property details this invoice applies to.

Rate descriptions - This is where you’ll find specific charges broken down for example if you are on the urban collection route and water supply schemes. More information about each of these rates can be found on the back of your invoice or on our website.

Units and rates – The ‘unit’ is the factor that each charge is based on, for example it could be your capital value (for your general rate), or it could be a flat charge per property (for your UAGC). ‘Rate’ is the amount charged per unit. ‘Annual amount’ is equal to the ‘unit’ multiplied by the ‘rate’ and is what you pay.

Total rates – This is the total amount of rates due for the year, including GST (yes – 15% of your rates bill is paid to central government in taxes).

Direct Debit - We will advise you if you have set up to pay your rates by Direct Debit. If you have set up to pay rates on a weekly, fortnightly, monthly or quarterly Direct Debit, you do not need to make any manual payments.

Payment details - Please always use your Valuation Roll Number when making any payment to us.

Property Details:

Valuation reference – This number is unique to your property so please make sure you use this number when making online payments or contacting us.

Land and capital value – These valuations are revised every three years. The current valuations are effective from 1 July 2022 which means the next revaluation will need to be complete and in place by 1 July 2025. More information can be found on our website.

Balance and payments:

Current balance is the amount due for payment by the date shown.

Current invoice amount is the total amount calculated for this instalment.

Opening Balance - This will show the balance on the account as at 1 July (the start of the rating year). Any arrears or credits from previous years will show here.

Previous instalment and payments received this year – If this is the second invoice of the year, previous instalments and payments (including any payments made between 1 July and this invoice date) will show here.

Penalties – A 10% penalty is applied to any amount outstanding from the previous instalment (we do not charge penalties on previous years’ outstanding invoices). The penalty will show here.

Adjustments - This will show any remissions or adjustments made to your account (more details on these are available on the website).

Balance brought forward – this is the opening balance plus or minus any transactions during the current year.